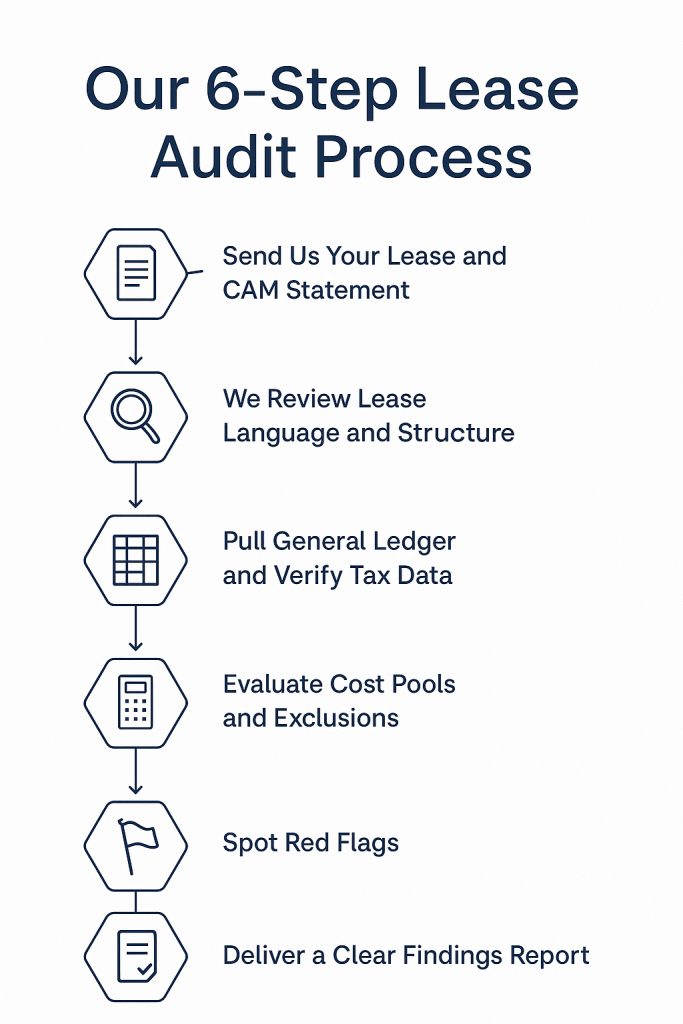

Our 6-Step Lease Audit Process

- Send Us Your Lease and CAM Statement

We begin with the basics — the lease and the CAM reconciliation you’ve received. - We Review Lease Language and Structure

We quickly assess the type of lease (NNN, modified gross, etc.), identify exclusions, and determine your rights and obligations. - Pull General Ledger and Verify Tax Data

We request the general ledger from the landlord and manually verify real estate tax charges through public assessor records. - Evaluate Cost Pools and Exclusions

We review how CAM charges are structured. Are capital items being passed through? Are utilities tenant-specific? Is everything actually “common”? - Spot Red Flags

We look for improper expenses like legal fees, leasing commissions, or miscategorized costs. If it seems “off,” we’ll dig into it. - Deliver a Clear Findings Report

We provide a summary report of findings with a recalculated pro-rata share, lease references, and a simple action plan.

Each audit is tailored to the lease, the building, and the type of business involved. Whether it’s one location or twenty, the process is streamlined, efficient, and focused on clarity.